|

Please join Historic Salem in supporting the Federal Historic Tax Credit.

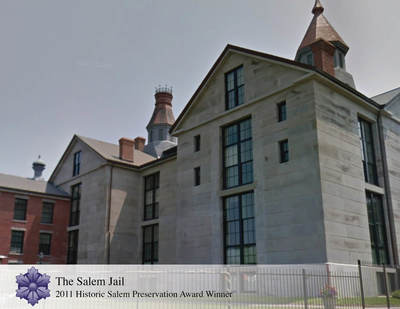

There is a real possibility that the Historic Tax Credit will not be included in Federal Ways and Means Chairman Brady's tax reform bill expected to be released on November 1. The bill could go to the floor for a full House vote as early as November 6, giving House members three days to amend. Let’s make sure the historic tax credit is included in the legislation. Please join us in acting now to show Washington that historic preservation advocates strongly support of the historic tax credit’s track record for creating jobs, revitalizing historic communities, and preserving our history. Why this matters: The Historic Tax Credit (HTC) encourages private investment in the rehabilitation of historic buildings. The credit attracts private capital—$131 billion since inception—to revitalize often abandoned and underperforming properties that have a financing gap between what banks will lend and the total development cost of the transaction. From a preservation standpoint this is obviously fantastic. HTC eligibility requires adherence to the Secretary of Interior Standards for Historic Rehabilitation as administered by the National Park Service. These rigorous standards mean the buildings will be brought back into use while also maintaining the historic features that make them unique and important. But in addition, the Historic Tax Credit has real economic value: In the past 30 years the rehabilitation of 42,293 historic buildings across the country has created more than 2.4 million jobs. In addition to revitalizing communities and spurring economic growth, the HTC returns more to the Treasury than it costs. In fact, Treasury receives $1.20‐1.25 in tax revenue for every dollar invested. That means that for the $25.2 billion in federal tax credits granted, more than $29.8 billion in federal tax revenue has been collected from historic rehabilitation projects. As local economic activity, historic rehabilitation greatly outperforms new construction in job creation. Rehabilitation project costs are on average 60 percent labor and 40 percent materials compared to new construction, which is about 40 percent labor and 60 percent materials. In addition to hiring local labor, historic rehabilitation materials are more likely to be purchased locally. As a result, approximately 75 percent of the economic benefits of these projects remain in the communities where these buildings are located. What you can do: The most effective way to advocate with our Federal representatives is through a phone call followed up with an email. Please see the directions and script below. Alternatively, you can click here to submit a letter through the National Trust for Historic Preservation website. Script for Calling and E-mailing ➢ Legislators need to know that their constituents support inclusion of the Historic Tax Credit in the House and Senate tax reform bill. Below is a script you can use to when calling the Washington office as well as the district offices of both senators and your representative. In Salem we are represented by: Senator Elizabeth Warren 202-224-4543 Washington, DC (617) 565-3170 Boston Email form Senator Ed Markey 202-224-2742 Washington, DC 617-565-8519 Boston Email form Representative Seth Moulton 202-225-8020 Washington, DC (978) 531-1669 Salem 21 Front Street Salem, MA 01970 Email form Step #1 Call your representatives and speak to their staff, or leave a message. Use the script below as a guide. Step #2 Call their district offices and ask to speak to the District Director and use the same script as below. Step #3 Finally, send an e-mail using a variation (so they don’t disregard your e-mail) of the Subject line: Historic Tax Credit-Tax Reform. Explain that you had called and ask that they communicate your concerns to your representative and two senators. SCRIPT 1. Introduce yourself 2. Say “I have been hearing about tax reform and I wanted to check in to see how the HTC is fairing. I am extremely concerned that is was not specifically mentioned in the tax reform framework. 3. Explain why you value Historic Tax Credits and that the redevelopment of historic buildings will not get done without the HTC. See top of this message for ideas. 4. Talk about recent projects and future projects that won’t happen without the HTC. In Salem we have approximately 30 projects that have been undertaken using Historic Tax Credits. These include many affordable housing projects in the Point Neighborhood, The Salem Jail, The Merchant Hotel, 90 Washington Street (the old Smoke Shop building) and many more. 5. Ask…. “As Congress moves forward on tax reform, please ask the Member to be vocal in their support to the Senate Finance Committee Chair, Orrin Hatch, Chairman Brady of the House Ways and Means Committee and others on the committees -- to keep this important incentive that allows redevelopment of our most challenging but historically significant buildings.” 6. End the call with a request for a response – something like “Would you please let me know your boss’ position on the Historic Tax Credit after you’ve had a chance to present this information I’ve shared?”

1 Comment

Tim Jenkins

11/15/2017 10:19:55 am

The HTC has been so important to the revitalization of Salem's historic downtown. I would like to add the old Salem Police Station and hopefully the old Superior Court and County Commissioner's office across from the train station. It is very important that we have our senators' and representative's support.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Categories

All

Archives

February 2024

Follow us on Instagram! |

|

|

Historic Salem, Inc. | 9 North Street, Salem, MA 01970 | (978) 745-0799 | [email protected]

Founded in 1944, Historic Salem Inc. is dedicated to the preservation of historic buildings and sites. Copyright 2019 Historic Salem, Inc. - All Rights Reserved

|